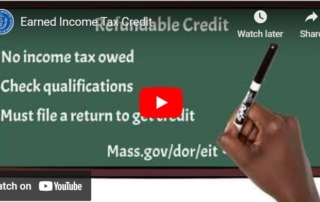

Earned Income Tax Credit

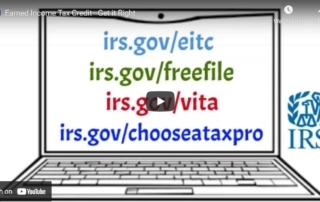

Did you know that there's a helpful tax relief program for low and moderate income working families? It's called the earned income tax credit (EITC) and it can help put some extra money in your family's pocket. Depending on your family's income, you could be eligible for a refund even if you don't currently owe income [...]