Jan. 31 Filing Deadline Remains for Employer Wage Statements, Independent Contractor Forms

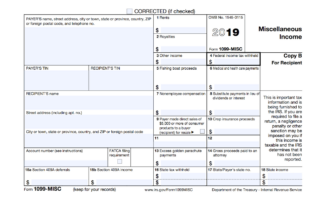

The following article was published by the IRS. Employers and other businesses should remember that wage statements and independent contractor forms still have a January 31 filing deadline. Before the Protecting Americans from Tax Hikes (PATH) Act, employers generally had a longer period of time to file these forms. But the 2015 law made a permanent [...]