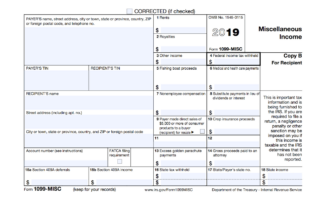

Earning Side Income: Is It a Hobby or a Business?

This article was published by the IRS. Whether it's something they've been doing for years or something they just started to make extra money, taxpayers must report income earned from hobbies in 2020 on next year's tax return. What's the difference between a hobby and a business? A business operates to make a profit. People engage [...]