New IRS Feature Allows Taxpayers Electronically Filing Amended Returns to Choose Direct Deposit to Speed Refunds

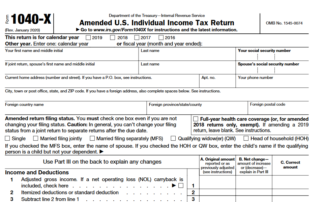

This article was published by the IRS. In the latest improvement for taxpayers, the Internal Revenue Service has announced that people electronically filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit for any resulting refund. Previously, taxpayers who filed Form 1040-X with the IRS [...]