IRS Launches Paperless Processing Initiative

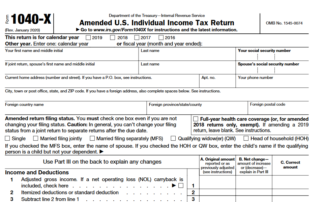

This article was published by the IRS. Taxpayers will have the option to go paperless for IRS correspondence by 2024 filing season, IRS to achieve paperless processing for all tax returns by filing season 2025 IRS paperless processing initiative will eliminate up to 200 million pieces of paper annually, cut processing times in half, and expedite [...]