This article was published by the MA DOR.

If you receive a Notice of Intent to Assess (NIA) or a Notice of Assessment (NOA) from the MA Department of Revenue, it is essential to understand the difference between the two. An NIA is DOR’s determination of additional taxes you might owe, while a NOA is a tax bill from DOR.

If you receive a Notice of Intent to Assess (NIA) or a Notice of Assessment (NOA) from the MA Department of Revenue, it is essential to understand the difference between the two. An NIA is DOR’s determination of additional taxes you might owe, while a NOA is a tax bill from DOR.

If you have a question about the information on an NIA that you receive, or want to dispute it, send DOR a secure e-message by logging in to MassTaxConnect, 24 hours a day, seven days a week, or by calling the Contact Center at 617-887-6367 during business hours. Do that within 30 days of receipt of the (NIA) or the bill (NOA) will be issued. Non-MassTaxConnect users can easily register online by creating a username and password.

Taxpayers can always see the balance due in their account and make partial or complete payments at their convenience on MassTaxConnect. Once your bill (NOA) arrives, you can set up a payment plan for any new liability once your bill (NOA) arrives.

Please view a video for an overview of the DOR Notices and Bills process. The video includes a high-level summary of how to respond to an NIA and NOA and outlines the steps for setting up a payment agreement.

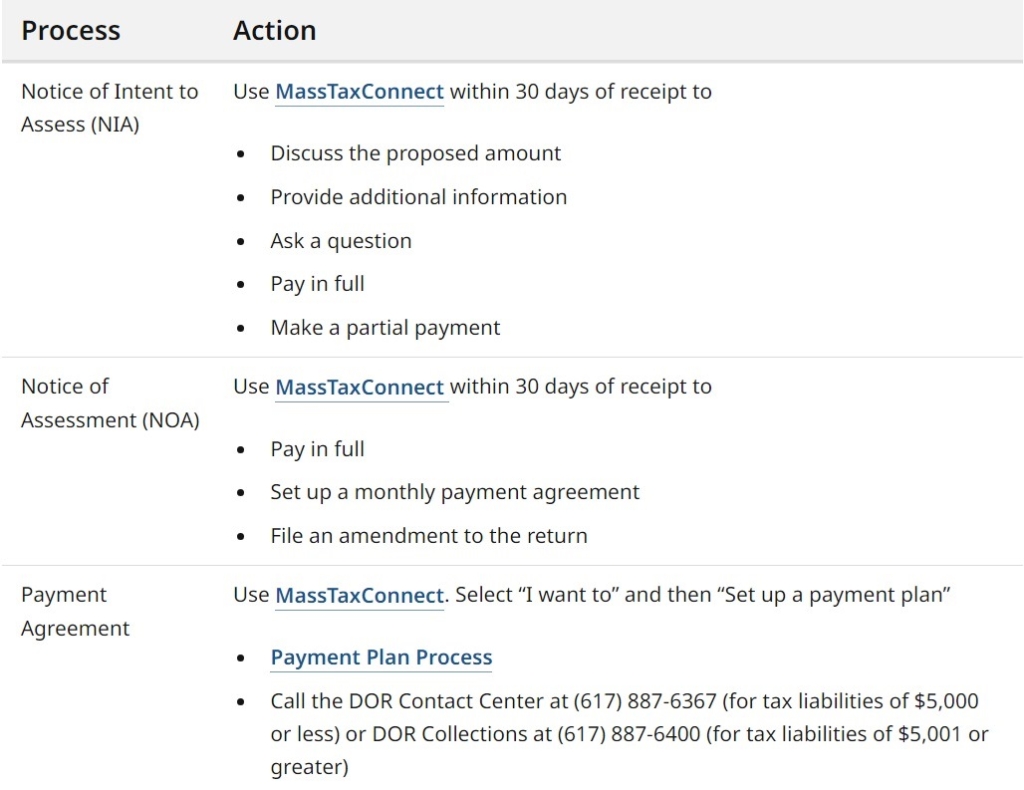

Review the chart below to learn about the options available through MassTaxConnect for responding to an NIA or NOA and setting up a payment agreement.

For more information, please visit: