The following article was published by the IRS.

The Internal Revenue Service has launched the new Tax Withholding Estimator, an expanded, mobile-friendly online tool designed to make it easier for everyone to have the right amount of tax withheld during the year.

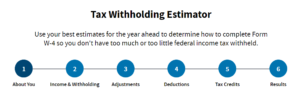

The Tax Withholding Estimator replaces the Withholding Calculator, which offered workers a convenient online method for checking their withholding. The new Tax Withholding Estimator offers workers, as well as retirees, self-employed individuals and other taxpayers, a more user-friendly step-by-step tool for effectively tailoring the amount of income tax they have withheld from wages and pension payments.

The IRS took the feedback and concerns of taxpayers and tax professionals to develop the Tax Withholding Estimator, which offers a variety of new user-friendly features including:

- Plain language throughout the tool to improve comprehension.

- The ability to more effectively target at the time of filing either a tax due amount close to zero or a refund amount.

- A new progress tracker to help users see how much more information they need to input.

- The ability to move back and forth through the steps, correct previous entries and skip questions that don’t apply.

- Enhanced tips and links to help the user quickly determine if they qualify for various tax credits and deductions.

- Self-employment tax for a user who has self-employment income in addition to wages or pensions.

- Automatic calculation of the taxable portion of any Social Security benefits.

- A mobile-friendly design.

In addition, the new Tax Withholding Estimator makes it easier to enter wages and withholding for each job held by the taxpayer and their spouse, as well as separately entering pensions and other sources of income. At the end of the process, the tool makes specific withholding recommendations for each job and each spouse and clearly explains what the taxpayer should do next.

The new Tax Withholding Estimator will help anyone doing tax planning for the last few months of 2019. Like last year, the IRS urges everyone to do a Paycheck Checkup and review their withholding for 2019. This is especially important for anyone who faced an unexpected tax bill or a penalty when they filed this year. It’s also an important step for those who made withholding adjustments in 2018 or had a major life change.

Those most at risk of having too little tax withheld include those who itemized in the past but now take the increased standard deduction, as well as two-wage-earner households, employees with nonwage sources of income and those with complex tax situations.

To get started, check out the Tax Withholding Estimator on IRS.gov.