This article was published by the IRS.

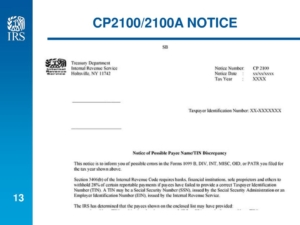

In April, the IRS sent CP2100 and CP2100A notices to banks, credit unions, businesses, or payers who filed returns that don’t match IRS records.

In April, the IRS sent CP2100 and CP2100A notices to banks, credit unions, businesses, or payers who filed returns that don’t match IRS records.

These information returns include:

- Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

- Form 1099-DIV, Dividends and Distributions

- Form 1099-G, Certain Government Payments

- Form 1099-INT, Interest Income

- Form 1099-K, Payment Card and Third-Party Network Transactions

- Form 1099-MISC, Miscellaneous Income

- Form 1099-NEC, Nonemployee Compensation

- Form 1099-OID, Original Issue Discount

- Form 1099-PATR, Taxable Distributions Received from Cooperatives

- Form W-2G, Certain Gambling Winnings

The IRS mails these notices out twice a year, in September and October and again in April of the following year. The notices tell payers that the information return they submitted is missing a Taxpayer Identification number or has an incorrect name or both.

Each notice has a list of payees with identified TIN issues. Payers need to compare the accounts listed on the notice with their account records and correct or update their records, if necessary. This can also include correcting backup withholding on payments made to payees.

The notices also tell payers that they are responsible for backup withholding. Payments reported on the information returns listed above are subject to backup withholding if:

- The payer doesn’t have the payee’s TIN when making the reportable payments.

- The payee doesn’t certify their TIN as required for reportable interest, dividend, broker, and barter exchange accounts.

- The IRS tells the payer that the payee gave an incorrect TIN, and the payee doesn’t certify their TIN as required.

- The IRS tells the payer to begin backup withholding because the payee didn’t report all their interest and dividends on their tax return.

Payers are responsible for the amount they failed to backup withhold and penalties may apply.